Managing bills can feel overwhelming, but with a few practical strategies, you can maintain control and avoid late fees. Here’s how to stay on top of your financial obligations.

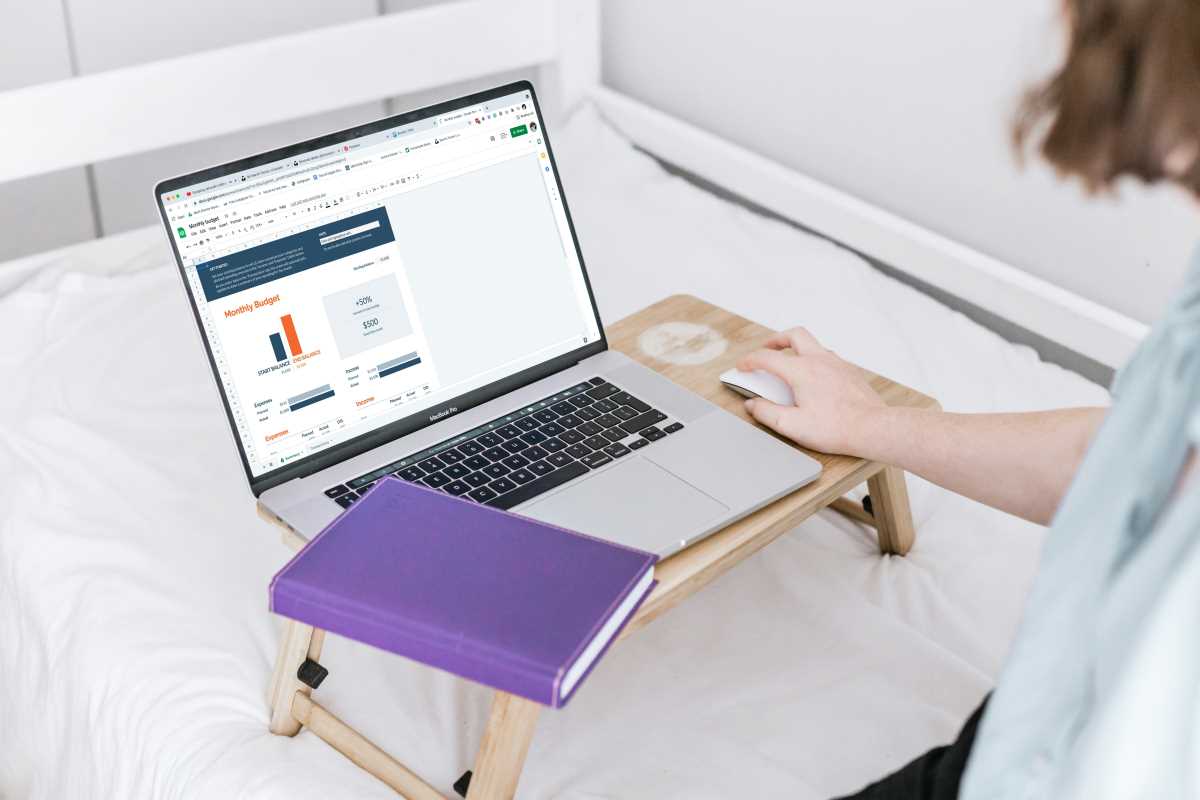

Create a Monthly Budget

The foundation of financial management is a well-planned budget. By listing your monthly income and expenses, you can see where your money goes and allocate funds for bills accordingly. This helps ensure that you don’t overspend in other areas, leaving you short when it’s time to pay bills.

70% of people with a budget feel in control of their finances.

30% of households struggle with budgeting regularly.

Set Up Automatic Payments

One of the easiest ways to stay on top of your bills is by setting up automatic payments. This ensures that you never miss a due date, which can save you from costly late fees and interest charges. Many banks and service providers offer this feature, allowing payments to be deducted directly from your account.

65% of consumers use automatic payments to manage bills.

$25 is the average late fee avoided by using auto-pay.

Organize Your Billing Dates

Synchronizing your billing dates can simplify the process. Requesting that your bills be due around the same time each month can help you track them more easily and plan your payments. This can be particularly helpful if you receive income on a regular schedule, like a monthly salary.

50% of people report difficulty managing bills with different due dates.

10-15 days is the typical grace period to adjust billing dates.

Prioritize Debt Payments

If you have multiple debts, prioritize them by interest rates. Paying off high-interest debt first can save you money in the long run. However, don’t neglect other payments—maintain minimum payments on all debts to avoid penalties.

20% of consumers focus on paying off high-interest debt first.

5% increase in savings can result from prioritizing debt effectively.

Use Alerts and Reminders

Set up reminders through your bank or a budgeting app to alert you when a bill is due. This additional layer of organization can help you avoid missing payments, especially if you don’t use automatic payments for all your bills.

40% of users rely on reminders to keep track of bills.

$100 is the average amount saved annually by avoiding late fees with alerts.

Review and Adjust Regularly

Your financial situation may change, so it’s important to review your budget and bill-paying strategies regularly. Adjusting your budget to reflect changes in income or expenses ensures that your bill payments remain manageable and accurate.

25% of people revise their budgets monthly.

15% find reviewing budgets helps avoid bill-payment issues.

Keep an Emergency Fund

An emergency fund can be a lifesaver if unexpected expenses arise. By setting aside a small amount each month, you can create a cushion that prevents you from missing bills when faced with unforeseen costs.

50% of Americans don’t have enough savings to cover a $500 emergency.

3-6 months of living expenses is the recommended emergency fund size.

Implementing these tips can help you take charge of your finances, reduce stress, and stay on top of your bills. By being proactive and organized, you can prevent late payments and improve your financial well-being.